I am hoping that headlines like these get to be repetitive, but since this blog is new and reporting of live results is still in the first year I’m going to make a big deal out of this when it happens.

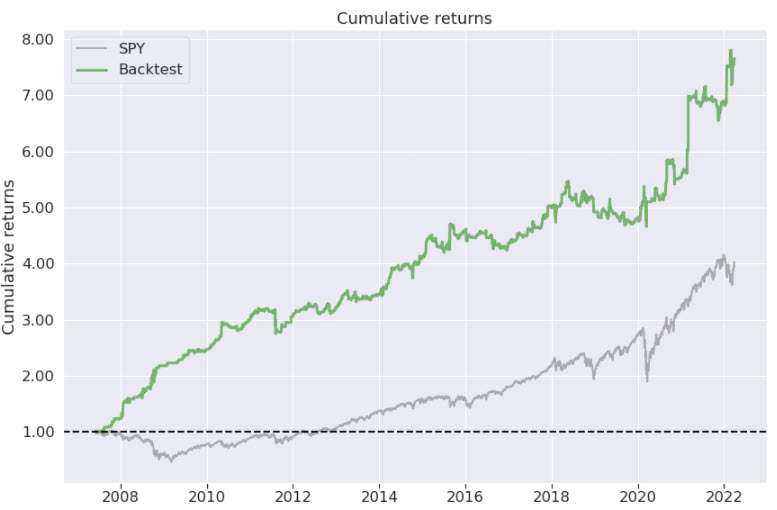

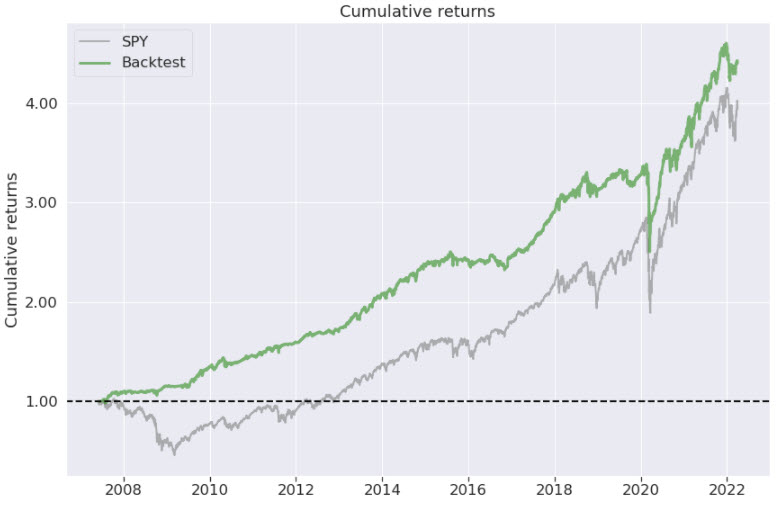

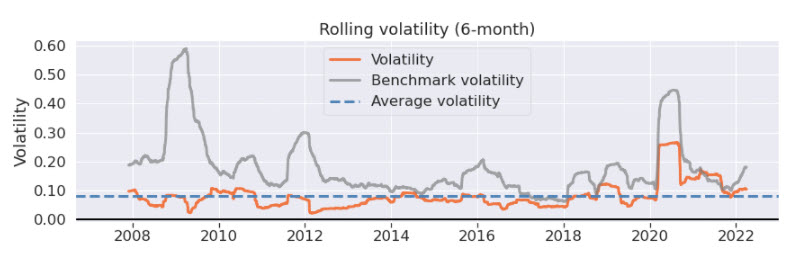

Referring back to earlier posts on the power of trading uncorrelated strategies with edge, we should expect to see higher returns with lower volatility than the S&P 500 Benchmark returns – which returned -4.61% in Q1 2022.

What were 2022 Q1 theoretical and unaudited actual results?

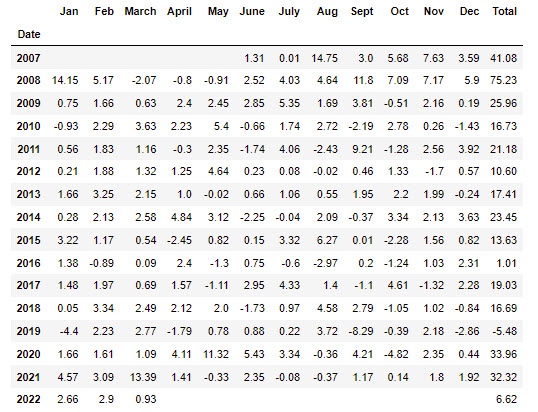

High Sharpe Portfolio

The theoretical returns for the High Sharpe portfolio were 6.62% for Q1 2022.

These returns don’t include any slippage, interest expense, missed trades due to hard to borrow stocks, or other day to day reasons why the real world intrudes on theoretical maximum returns.

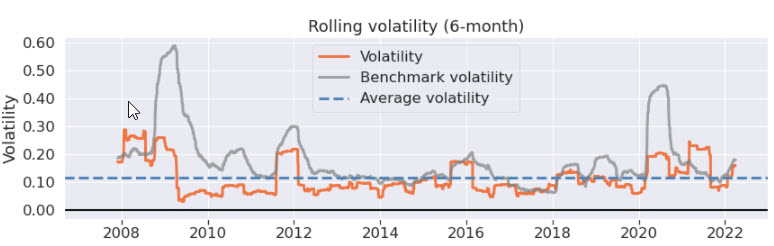

The High Sharpe portfolio truly had a chance to shine this quarter – outperforming the benchmark by 11.23%. It’s also important to point out that the portfolio spent almost the entire time at lower volatilities than the benchmark, and the few times volatility exceeded to the upside, profitability usually benefitted as well.

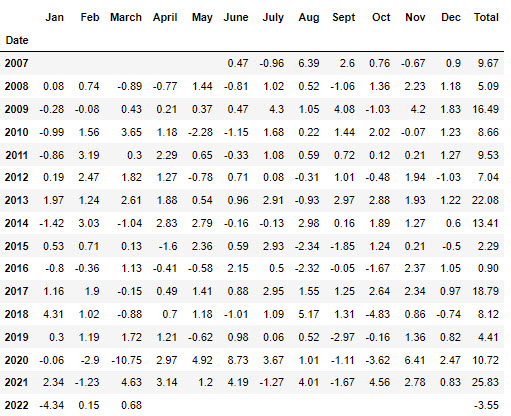

Quantum Return Portfolio

The theoretical returns for the Quantum Return portfolio were -3.55% for Q1 2022.

These returns don’t include any slippage, interest expense, missed trades due to hard to borrow stocks, or other day to day reasons why the real world intrudes on theoretical maximum returns.

A solid quarter for the Quantum Return fund, beating the benchmark by 1.06%, with solidly less volatility than the SP 500. While it is true that performance does not match that of the High Sharpe Fund, the Quantum Return fund does not utilize margin which makes it accessible for IRA accounts and enables investors desiring higher returns for lower volatility to take advantage of uncorrelated strategies.

Real World Results

How did the portfolios do in real world? Unaudited returns of actual accounts trading the High Sharpe and Quantum Return Portfolios for 2022 Q1 show 5.34% and -2.59% returns, respectively. There can be multiple reasons for the roughly +- 1% performance difference in each, and I will continue to monitor performance to see if this can be improved over time.

The important takeaway is that performance substantially matches the expected outcome – and the expected outcome handily beat the benchmark!

Going forward I expect the market to be relatively volatile and to yield low real returns – which should make these strategies really come into their own!

The average annual return on equities is only 8% – it doesn’t take beating the benchmark by 10% many times to really make any portfolio manager shine!