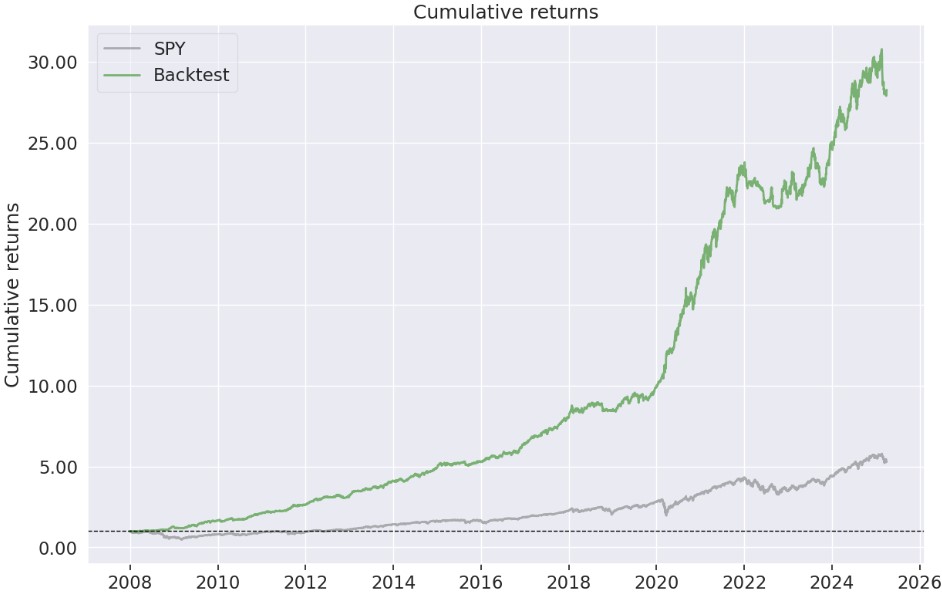

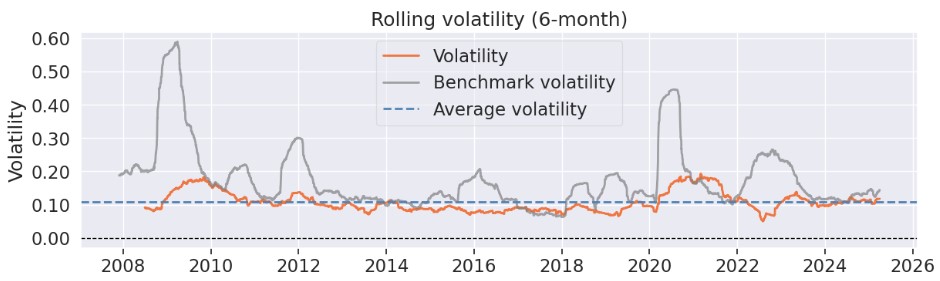

Generate returns that beat the S&P 500 on an absolute and risk adjusted basis. This is achieved by utilizing multiple low correlation investment strategies and asset classes in a portfolio approach.

Quantum Return Portfolio Hypothetical Performance For Sophisticated Investors ONLY

Our Objective

Portfolio Highlights

Securely delivered with transparency, liquidity, and convenience via separately managed accounts.

Minimum Account Size: $100,000

Portfolio performance is shown net of the advisory fees of 1.00% and trading execution costs.

Actual performance of client portfolios may differ materially due to slippage, timing related to client deposits or withdrawals, hard to borrow stocks, short stock rebate rates, and other factors.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS