YTD SPY performance is -23.3% as of 10/10/2022. And while that may be painful – there is enough unresolved bad news percolating in the market that this may well not be the end of the the bear market.

Overall the funds have benefitted from investing in multiple, uncorrelated strategies. That being said, there remains an overall bias towards long investing and historically when stocks did poorly bonds did better and vice versa. In the recent inflationary regime that relationship has not held true, resulting in different correlations between strategies and different bond behaviors.

All of that notwithstanding, the performance of the portfolios was still quit satisfactory – and we are working on some exciting ideas to reduce impact and/or take advantage of these new behaviors.

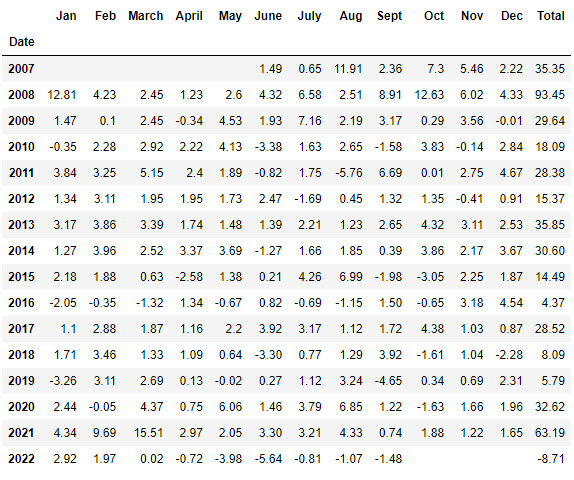

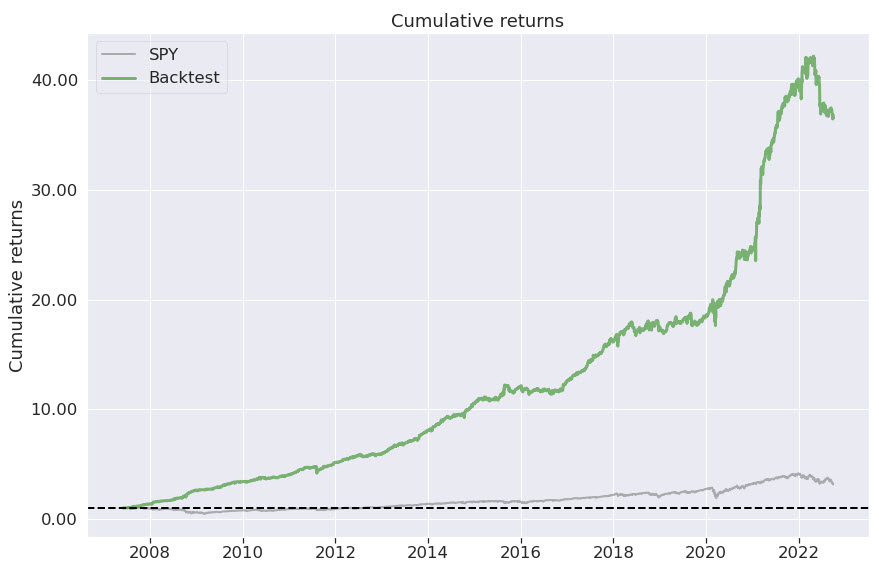

Let’s take a look at High Sharpe Q3 Performance!

Note that these results include enhanced strategy changes and capital allocations so they are NOT directly comparable to previous charts. It’s fine if you do – just keep in mind these results are using the better strategies.

Also keep in mind that EVEN BETTER results are coming soon.

Note: These returns don’t include any slippage, interest expense, missed trades due to hard to borrow stocks, or other day to day reasons why the real world intrudes on theoretical maximum returns.

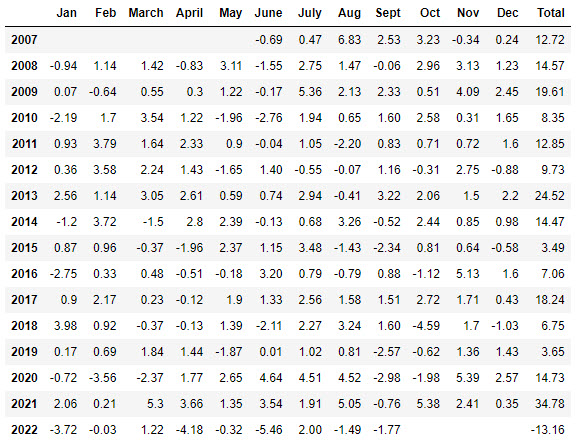

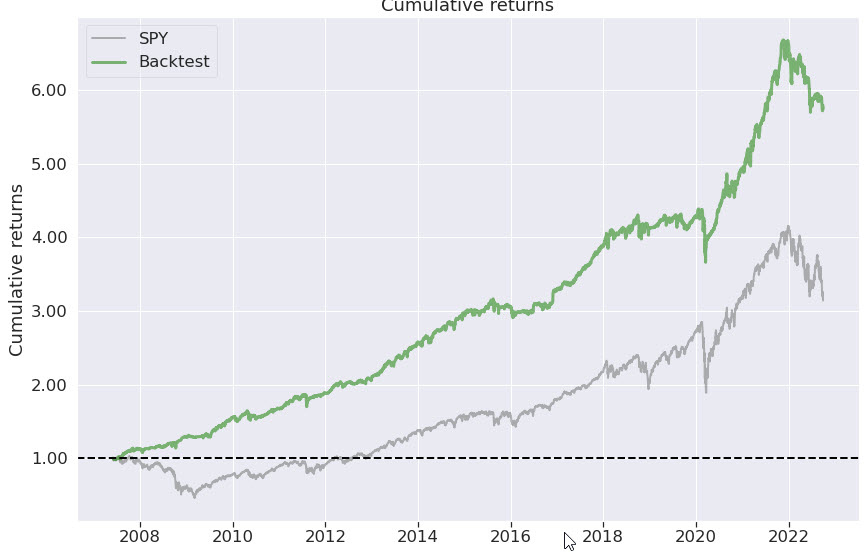

The Quantum Return fund is down -13.16% this year – about half the move of the SPY. This is principally because this fund is unable to trade short, and because of the inflationary disconnect that has been introduced this year between stocks and bonds. The good news is that we have a new strategy that can take advantage of volatility trading to earn income even for IRA’s – and soon we will be refactoring the strategies for the Quantum Return fund to take advantage of it and other high performance, higher returning strategies.

Comparing performance with previous periods will not be possible directly as is the case with High Sharpe, some of the strategies were enhanced this period and therefore the backtested results reflect these changes.

I’ve got to say I’m extremely excited by the work I’ve been doing in the background.

The preliminary results are very promising – with low drawdowns (below 10% if you can believe it) with returns in the 30%/year range for the leveraged fund – and it will mean significant improvements for the Quantum Return fund as well.

That’s extraordinary in my book – and I’m going to do everything in my power to deliver it as soon as possible!

Stay tuned!