Robert T. Kiyosaki has made a deserved fortune by illustrating to millions the path to true wealth is to make your money work for you rather than to work for your money. He has done this through a series of best selling books helping to educate them on how to enter the world of personal finance and investing.

Because of this deserved success, Mr. Kiyosaki has a very large social media audience and when he speaks on financial issues, the 10’s of thousands of his readers undoubtedly listen.

On 9/30/21, He appeared in this video – announcing that the ‘”world’s biggest crash will take place”. As of 10/30/21 (the end of that very month), the market was UP 7%. How much money did he cost them?

Undeterred, on 11/6/21, Mr, Kiyosaki made this announcement: The US stock market is headed for ‘giant crash’ followed by a new depression — here are the only 3 assets he likes as protection. As of 11/22/21, the market is up .6% Admittedly, he isn’t wrong by much yet, – but he isn’t right either…

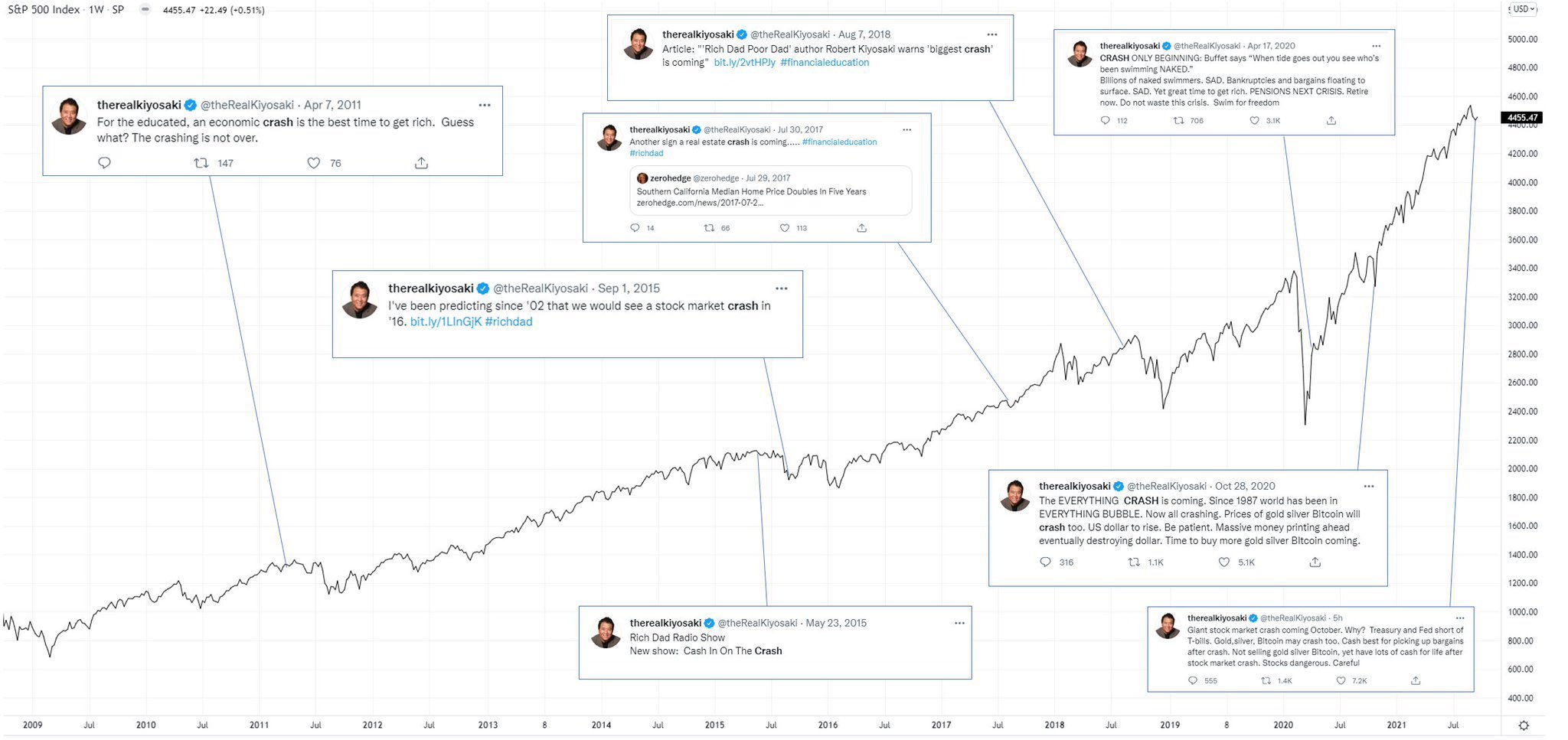

My curiosity piqued, I decided to see if there were other crash predictions he has made in the past – and it turns out there have been quite a few.

As you can see, while Mr. Kiyosaki has been occasionally correct, he has very often been quite wrong – by a LOT – and you somehow never see him calling for the inevitable massive rallies that follow.

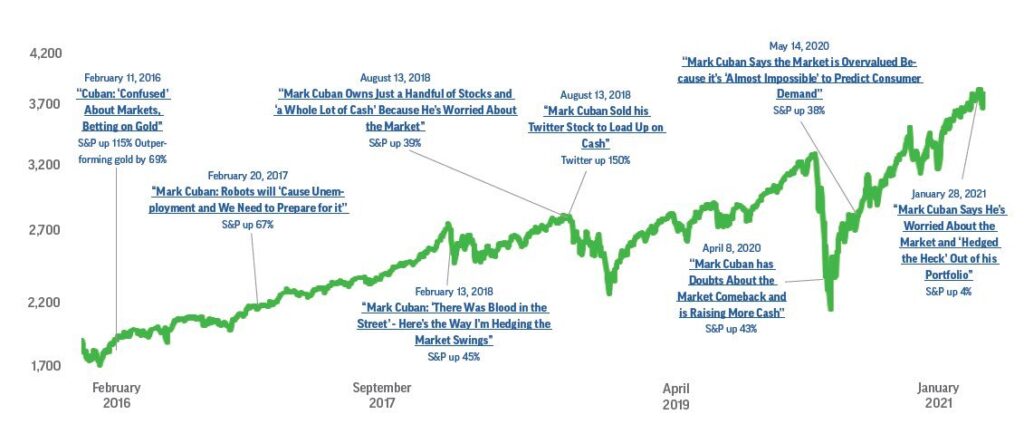

Lest you think I’m picking on Mr. Kiyosaki specifically, Mark Cuban seems prone to the same market timing disease. Here are his prognostications:

As you can see, he has not done much better.

You might be thinking that if these guys can’t “time the markets”, that “of course timing the markets doesn’t work” and that anyone that tries to do it is foolish indeed.

If attempted this way, I agree with you 1000%!

Don’t give up hope. There is a right way to do it that works – and works amazingly well.

The first thing to do is identify BASIC market behaviors and model them. We aren’t talking rocket science here – rock solid foundational behaviors that happen no matter what. So, what are these?

1. Markets Go Up

2. Markets Go Down

3. Markets Crash

Can we agree that these three regimes broadly cover market behavior? There aren’t very many ways to go after you eliminate up and down after all – and I reserve the market crash as a separate scenario from “market down” because significant asset correlation breakdowns and liquidity crunches occur in these situations.

Having come up with a model for market behavior, we next construct investment strategies that take advantage of market conditions when the market offers them and yield alpha when they occur. Note that this is a very different mindset from simply buying into an asset for the risk/reward that asset or asset class provides. It also provides us with the ability to get out of the prediction business altogether. There is no need to predict the next short for example: a good short strategy will take every short offered and will be ready when opportunity knocks.

Let us examine a cumulative return graph for a short only strategy benchmarked against the SPY. Notice that the returns outperform the benchmark despite ALWAYS trading short, which is a remarkable achievement given the upward bias of the market.

Imagine the possibilities that start to unfold with a fully constructed portfolio of strategies that take advantage of Market Up, and Market Crash, as well as Market Down behaviors!

Now you are starting to see the true power of this approach!

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS